Crisis Involving Adani and SEBI’s Regulatory Challenges

The crisis involving the Adani Group has posed formidable regulatory challenges for the Securities and Exchange Board of India (SEBI). The background of this crisis can be traced to allegations of stock price manipulation, accounting irregularities, and undisclosed related-party transactions by the conglomerate. These serious allegations had a ripple effect, significantly impacting investor confidence and the financial market’s stability.

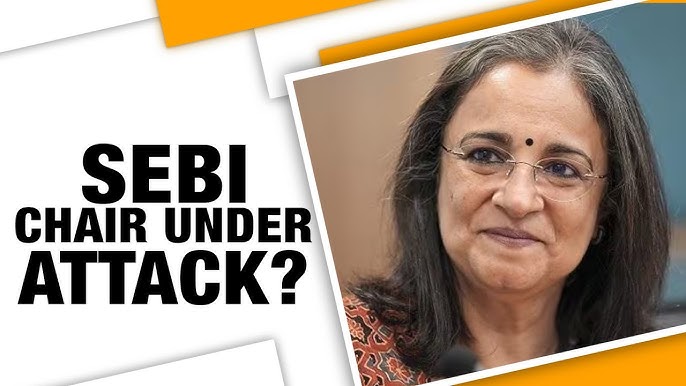

In response to these allegations, SEBI, under the leadership of Madhabi Puri Buch, embarked on a comprehensive investigation into the Adani Group’s operations. The regulatory body faced enormous challenges during this process due to the conglomerate’s expansive and intricate corporate structure, as well as its significant influence on the market. Despite these hurdles, SEBI’s mandate was clear: ensure transparency, accountability, and the protection of investor interests.

SEBI’s regulatory challenges were compounded by the need to balance rigorous enforcement with maintaining market stability. There were concerns that any drastic regulatory action could trigger a market downturn, further shaking investor confidence. Thus, SEBI had to tread carefully, ensuring thorough investigations while being mindful of the broader economic implications.

Under Madhabi Puri Buch’s stewardship, SEBI implemented various measures to manage the situation. This included enhanced monitoring of stock market transactions, closer scrutiny of corporate disclosures, and stringent enforcement actions against violations. Despite these efforts, the pressures on Buch and her team were immense, as the crisis demanded a high degree of regulatory vigilance and swift decision-making.

Broader implications of the Adani crisis extended beyond immediate financial losses. The credibility of India’s regulatory framework came under scrutiny, necessitating reforms to bolster its robustness. SEBI’s actions during this period were pivotal in signaling to both domestic and international investors that the regulatory body was committed to upholding market integrity, despite facing significant challenges.

Madhabi Puri Buch’s Tenure and Achievements

Madhabi Puri Buch assumed the role of Chairman at the Securities and Exchange Board of India (SEBI) with a mandate to drive regulatory reforms and enhance the integrity of the Indian financial markets. Her tenure has been marked by a series of notable initiatives aimed at bolstering market infrastructure and investor confidence. One of her significant contributions includes the introduction of tighter disclosure norms to enhance transparency, particularly in the wake of several high-profile corporate scandals.

An ardent advocate for technological integration, Buch spearheaded the adoption of advanced analytics tools to detect market anomalies and ensure more robust surveillance mechanisms. This technological uptick has been instrumental in identifying and mitigating fraudulent activities, thereby fortifying market resilience. Under her leadership, SEBI witnessed significant advancements in market supervision, improving both efficiency and reliability.

Moreover, Buch has been lauded for her efforts in improving corporate governance frameworks. This involved the implementation of stringent rules mandating greater accountability from corporate boards and executive management. These reforms aimed to align the interests of various stakeholders, ensuring that corporate actions are more transparent and aligned with shareholder value creation. Such measures have considerably elevated the standards of corporate governance in India.

In the context of the ongoing crisis involving the Adani Group, Buch’s proactive approach is commendable. She has prioritized timely and thorough investigations while ensuring adherence to due process, thus maintaining regulatory credibility. This instance underscores her commitment to handling crises with prudence and equanimity, reflecting her adeptness in crisis management.

Prior to her tenure at SEBI, Buch accumulated an impressive career portfolio. With significant stints at ICICI Bank and subsequently as a Managing Director and CEO at ICICI Securities, she cultivated a wealth of experience in financial services. Her expansive career, coupled with her reform-driven approach at SEBI, underscores her as a pivotal figure in the regulatory landscape of India.

Toxic Work Culture and Employee Complaints at SEBI

The Securities and Exchange Board of India (SEBI) has been facing significant internal challenges, particularly related to its work culture and the surge in employee complaints. Reports indicate a pervasive toxic work environment characterized by excessive micromanagement, lack of transparency, and undue pressure on employees by senior management. This environment has been cited as a primary driver of dissatisfaction and discontent among the staff.

Numerous employees have voiced their grievances about the unprofessional conduct within the organization. Complaints range from allegations of favoritism and unfair treatment to instances of harassment and intimidation. Such issues have significantly impacted morale, leading to a palpable sense of disenchantment. Some employees have specifically pointed out that the leadership, including the chairperson Madhabi Puri Buch, has not adequately addressed these concerns, leading to a perception that the top management is either complicit or indifferent to the problems at hand.

The handling of these complaints has been under scrutiny. Internal investigations have often been criticized for their lack of thoroughness and impartiality. Furthermore, external pressures, particularly from industry watchdogs and media outlets, have intensified. These external forces have demanded greater accountability and transparency from SEBI, making it difficult for the organization to manage its internal and public image simultaneously.

The toll of such a work environment on SEBI’s functionality cannot be understated. Employee morale and productivity have been adversely affected, which, in turn, impacts the regulatory body’s operational efficiency. The mounting internal complaints and the toxic work culture have played a significant role in precipitating the current crisis within SEBI.

Madhabi Puri Buch’s impending resignation is seen as a direct consequence of these cascading issues. The inability to effectively tackle the toxic work culture and address employee grievances is closely tied to the broader crisis that SEBI faces today. Her resignation marks a pivotal moment for the organization, underscoring the need for a thorough reevaluation of its internal policies and leadership strategies.