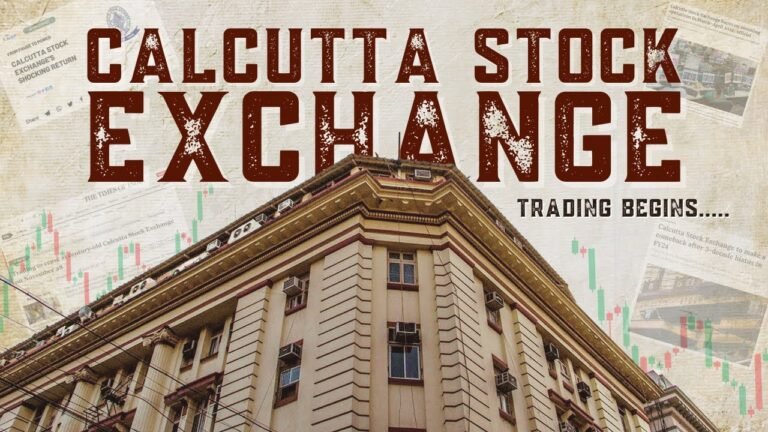

Calcutta Stock Exchange

West Bengal Chief Minister Mamata Banerjee has in a historic announcement announced closure of one of the most ancient trading platforms in India Calcutta Stock Exchange (CSE). The ruling concludes a period of time that started in 1908 when the exchange was set up as a center of exchange in the eastern India financial and trade activities. The exchange officially comes to an end after years of deteriorating business and regulatory issues.

The announcement to close it was made by the Chief Minister in a press conference in Kolkata where he showed his sadness as well as determination regarding the decision. It is a rather emotional time of Bengal financial community. The Calcutta Stock Exchange has a good history, however the times have changed. The trading volume and number of investors could not be reinstated, despite the numerous revival attempts, she said.

The Calcutta Stock Exchange used to be the second-largest stock exchange in India after the Bombay Stock Exchange in its heyday in the late 1980s and early 1990s. It was the main market place of thousands of traders and small investors of eastern India. But electronic trading, stiff competition with the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) and the stringent regulation requirements by the Securities and Exchange Board of India (SEBI) slowly drove CSE to the downfall.

By the beginning of the 2000s, a majority of its members had moved to national exchanges that were more liquid, technologically advanced and more integrated with modern trading systems. They tried to revive the CSE by joining forces, digital marketplaces, and regional joint ventures, but none of them managed to boost its financial viability.

Chief Minister Mamata Banerjee also highlighted how the government is looking into how they can utilize the CSE building and infrastructure to new financial and technological endeavors. We are thinking of transforming the location and it will be a fintech hub of startups and digital finance firms. Bengal will not forget its monetary past it will develop, she said.

Past brokers and workers of CSE have given mixed feelings regarding the closure. Some miss the golden days of the exchange and others think that it was a much-needed move due to the economic facts. Once the place to be proud of the business fraternity of Kolkata, at present it is difficult to run an independent exchange in a business where two national giants are in charge.

Economists claim the close-up indicates a bigger concentration of the financial market in India in Mumbai. Kolkata was also weak in terms of the financial ecosystem of the city since it lacks major corporate headquarters and institutional investors. However, some experts think that the increasing digital economy of Bengal has left open new possibilities in financial technology, which can help the city to gain importance as a financial player in the future.

The shutdown of the Calcutta Stock Exchange is symbolic It is not merely the closure of a trading floor, but the end of a chapter in the history of the Indian financial development. The exchange was once a busy hub full of brokers, investors and ringing telephones, but will now be remembered as part of the Indian economic history.

According to Mamata Banerjee, the same spirit that created Calcutta Stock Exchange will stay there just in a new guise, new age appropriate.