Carraro India has come into the market, and it has received mixed reactions from the investors.

Since it was listed at a discount, this company’s good fundamentals and great growth prospects caught the attention of the market experts, who are projecting exponential returns in the long term.

Here, we will discuss the details of the IPO, analyze the market outlook, and evaluate the prospects of Carraro India.

IPO Overview

Carraro India is an India-based subsidiary of the global entity Carraro Group. The company specializes in producing drivetrain systems and parts for agricultural and industrial machinery.

At ₹ 300 apiece, the IPO went relatively cold at the opening bell with listing prices selling at a 5% discount due to market conditions.

Analysts, though, believe this initial underperformance to be short-term in nature considering the solid business model and growth trajectory of the firm.

Key IPO Details:

1. IPO Price Band: ₹280-₹300 per share

2. Issue Size: ₹1,200 crore

3. Purpose of the IPO: Debt reduction, capacity expansion, and R&D investment

4. Anchor Investors: Several institutional investors, including mutual funds and foreign investment firms, have shown strong interest.

Market Outlook

Indian industrial sectors have vast growth potential due to initiatives like Make in India and increasing infrastructural development.

Carraro India’s products align well with such initiatives and is, thus well placed for capitalizing on increasing demand.

1. Revival of Agriculture Sector: With the mechanization of agriculture, demand for Carraro’s drivetrain systems would be expected to increase.

2. Industrial growth: Expansion of construction and manufacturing activities favours the company’s industrial machinery components business.

3. Export Opportunity: Carraro India enjoys an export business as well. Since the exports form a major component of this, it supports their business mainly, as global market demand is experiencing growth in drivetrain high-class solutions.

Why the Experts are Optimistic:

Though it is listed at a discount, market experts feel that the company will turn in returns of 10x that investors can expect in the next decade. Here’s why:

1. Strong Parentage: It is sponsored by the Carraro Group, thereby drawing the world-class technology, global network, and operational knowledge in the business group’s knapsack.

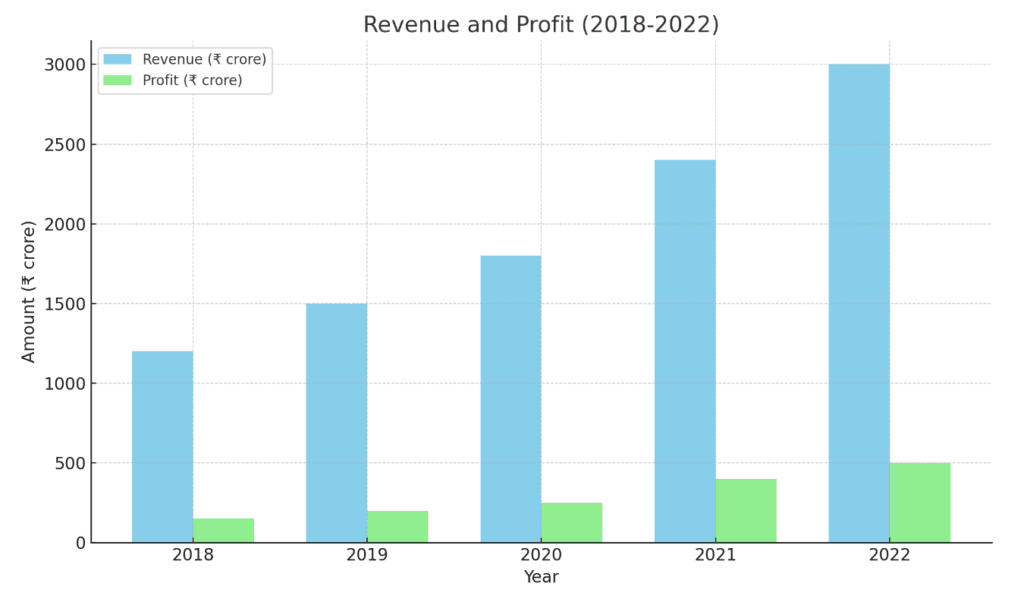

2. Strong Financials: Over the last five years, the company has grown at a CAGR of 25% in revenues and profit.

3. R&D Intensity: Innovations have given the company an edge in the drivetrain technology where it enjoys sustainable competitive advantage.

4. Increased Capacity: The IPO will increase production capacities significantly to avoid supply constraints from future demand.

5. Sustainability Initiatives: With green energy being on an ascendancy, the Carraro’s energy-efficient solutions suit the newly developing sustainability theme around the world.

Growth Potential

Carraro India is set to grow with innovation-driven growth. The path of its growth would be comprised of:

1. Diversification: Carraro India provides drivetrain solutions in EV and the space has acquired significant importance all over the world.

2. Geographical Expansion: Further consolidation in other emerging markets, especially in Africa and Southeast Asia.

3. Strategic Alliances: Agreements with the OEMs to design co-operative next generation drivetrain systems.

Investment Risk

On the bright view side of this proposition, there should be reflected against reality risk assessment for an investment, the ones which comprise,

1. Slow Economic Cycles: It might affect demand for machine components.

2. Competition: Highly competitive industry; a very number of contenders fight for its pie in the marketplace.

3. Currency Fluctuations: Being an export-dependent company, the revenue will be affected by currency fluctuations.

Graph: Carraro India’s Revenue and Profit Growth

Below is the graphical presentation of Carraro India’s revenue and profit growth of the last five years.

Table: Critical IPO Parameters

| Metric | Value |

|---|---|

| IPO Price Band | ₹280-₹300 |

| Issue Size | ₹1,200 crore |

| Market Cap (post-listing) | ₹4,000 crore |

| PE Ratio | 15x (at listing) |

| Debt-to-Equity Ratio | 0.3 |

| Expected CAGR (next 5 yrs) | 20% |

It would be a very unique offering with both value and growth through the IPO of Carraro India.

Actually, though the discount may be rather low at initial stages, the record that the company maintains in terms of its growth prospects and market positioning is impressive enough to attract long-term investment avenues.

When industrial and agricultural sectors see growth, substantial gains are bound to come into play for Carraro India.

For all those inspired by stories of resilience and ambition, follow us on X/Twitter at https://x.com/ThePhilox and on Instagram at https://www.instagram.com/philoxbox/. For those with untold stories that you would love to share, please send them to contact@thephilox.com