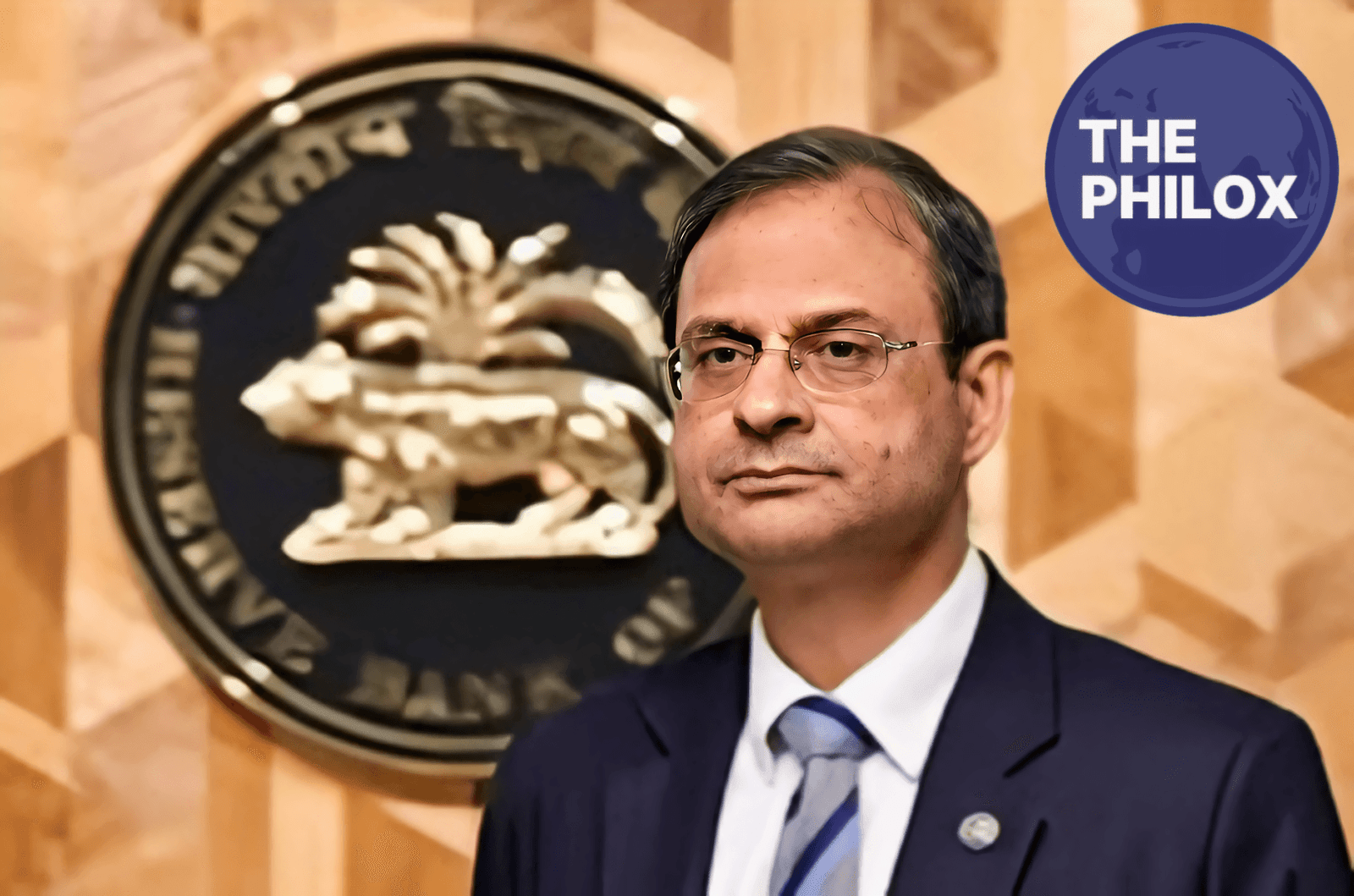

The Indian financial system was shaken today as the RBI Governor Sanjay Malhotra has made liberal and alarming statement at an economic discussion. He stated that the Indian Rupee would reach 100 against the US Dollar by the end of next year should the world and domestic forces move the same way. Economists, investors and the general population have taken notice of his remark because the prices, savings and nearly all aspects of the everyday lives of Indians are influenced by the value of the rupee.

For advertisement on our platform, do call at +91 6377460764 or email us at contact@thephilox.com.

According to Malhotra, emerging market currencies are under pressure due to global economic slowdown, the increasing price of oil and the emerging global political tensions. These global trends are also taking their toll in India though it has good fundamentals. According to him, the RBI will continue to make measures to bring volatility under control, but some aspect of movement in the rupee is normal given the conditions in the global markets.

He also added that another significant factor is the strengthening of the US Dollar. As the American economy performs, the investors are likely to shift to the dollar, resulting in a fall in the currencies such as the Rupee. Malhotra acknowledged that India is making efforts to enhance the export, increase inflow of foreign investments and maintain inflation under check but the coming year can still be a challenge.

Several analysts are of the opinion that imported products like petrol, mobile phones, electronics and foreign traveling may be costly should the rupee appreciate the 100 mark. Nevertheless, some good might come as well, such as the exporters getting better profit when they use dollars. Malhotra promised that the RBI will still keep an eye on the situation and act when need arises in order to save the stability of the Indian economy.

The statement has made the financial circles bustle with debates, as many people hope that the situation will be better before the rupee will be near 100 mark. To date, the warning issued by the RBI has made it apparent that the next few months will be crucial to the state of the Indian economy.