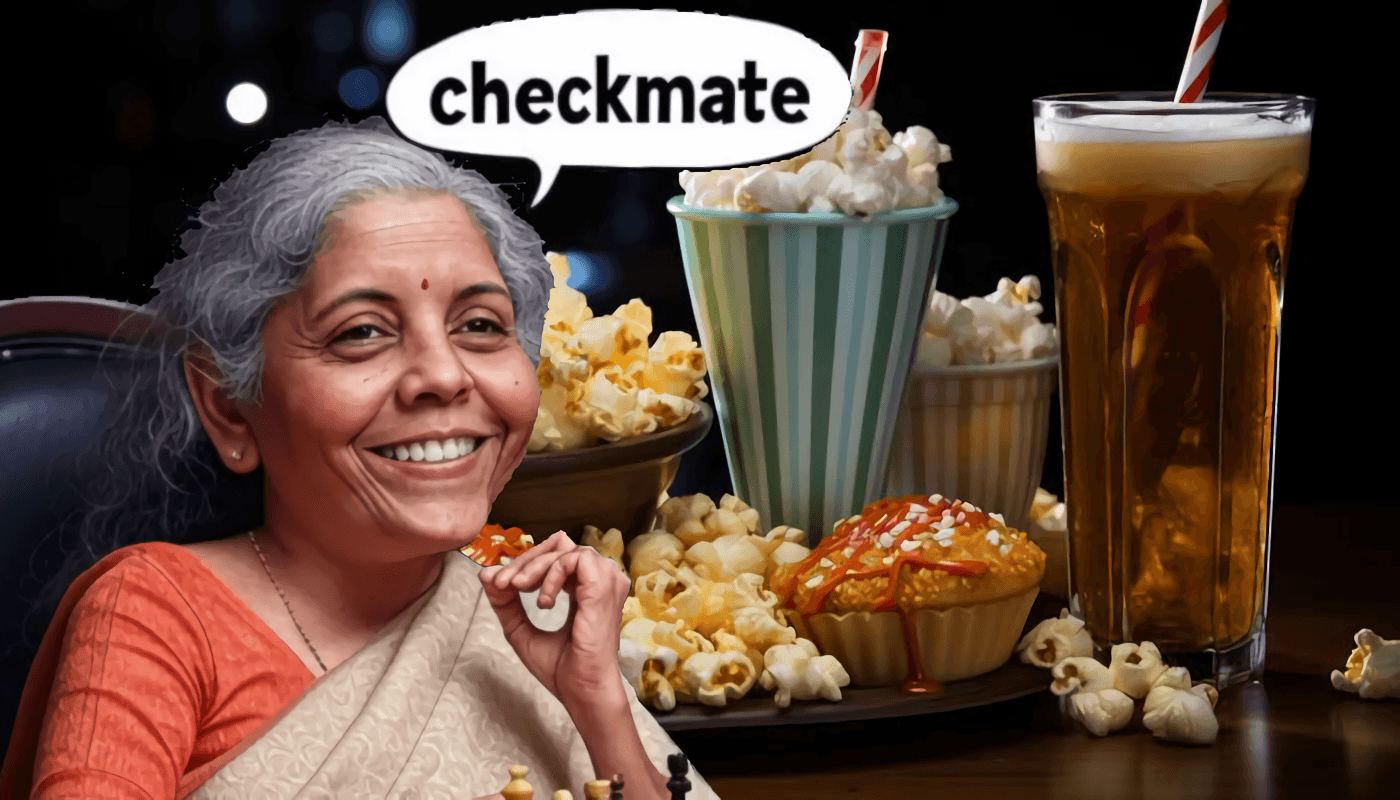

It’s a recent decision of the Goods and Services Tax Council to levy different tax slabs on popcorn that started the debate on flavor-based taxation. The GST of 5%, 12%, and 18% applied to different types of popcorn may soon be implemented on biscuits and cookies as well. This may lead to a rise in prices for premium products, but it would also open up opportunities for SMEs as the tax burden would be reduced. However, the shift to flavor-based tax slabs would create problems such as administrative complexity and misclassification. The implications for consumer behavior, industry dynamics, and future food products are significant.