Why Investing in Bitcoin May Not Be a Good Idea: A Critical Review

Bitcoin is definitely the most prominent cryptocurrency lately. A recent price surge reportedly due to such factors like Donald Trump’s winning of the elections as well as heightened market speculation, makes Bitcoin very attractive for investors looking for lucrative investments.

However, closer inspection suggests that a significant investment in Bitcoin may not be a smart move, especially for an investor seeking stable long-term advantages.

Why Will Bitcoins Fall and Thus Why Investing in This Currency Is So Risky

Bitcoin Price Volatility

The price of Bitcoin is notoriously volatile. Recent events, such as Trump’s election win, pushed the prices temporarily up, but history indicates that these movements are fleeting. Consider the following examples from the past:

- In 2021, Bitcoin jumped to almost $69,000, only to see its price plummet to under $20,000 just over a year later.

- The cryptocurrency market lost nearly $2 trillion in value during the 2022 downturn, highlighting its susceptibility to extreme fluctuations.

- Volatility is driven by speculative trading, lack of intrinsic value, and susceptibility to market sentiment. Such instability makes Bitcoin a high-risk asset unsuitable for conservative or long-term investors.

Macroeconomic Factors at Play

Prices are currently supported by temporary factors such as geopolitical events and speculative hype. Macro conditions, however, indicate this is not sustainable:

Federal Reserve Policies

The U.S. Federal Reserve continues to maintain high interest rates to stifle inflation, which will rob riskier assets such as Bitcoin of their shine. Investors will look at stable investments such as government bonds and blue-chip stocks when risk aversion is pumped in rather than currencies that can go either way.

Regulatory Crackdowns

Governments around the world are increasingly scrutinizing cryptocurrencies:

- US SEC has targeted major exchanges like Binance and Coinbase for regulatory violations.

- India has imposed a 30% tax on cryptocurrency gains, which has decreased trading volumes considerably.

- Increased regulation is expected to deter institutional investors and further depress Bitcoin prices.

No Intrinsic Value

Bitcoin does not possess intrinsic value, meaning that it is not associated with any physical asset or productive activity. As opposed to gold or stock, which can be used or have dividends, Bitcoin’s value is determined by mere market demand.

Hence, the whole nature of Bitcoin forms it to resemble a financial bubble. There are plenty of illustrations in the form of asset bubbles bursting eventually in history:

- The Tulip Mania of the 1600s

- The Dot-Com Bubble in the early 2000s.

- When speculative interest wanes, the prices of Bitcoin may follow suit.

Energy Consumption and Environmental Impact

Bitcoin’s underlying technology, called blockchain, makes use of a consensus mechanism known as Proof of Work (PoW). This process is energy-intensive:

- Bitcoin mining accounts for around 150 terawatt-hours (TWh) annually, comparable to the electrical consumption of countries such as Argentina.

- It leads to carbon emissions; research estimates that Bitcoin mining emits over 70 million metric tons of CO₂ every year.

- As the world shifts toward greener energy practices, Bitcoin’s environmental impact may lead to more severe regulations and therefore reduced adoption.

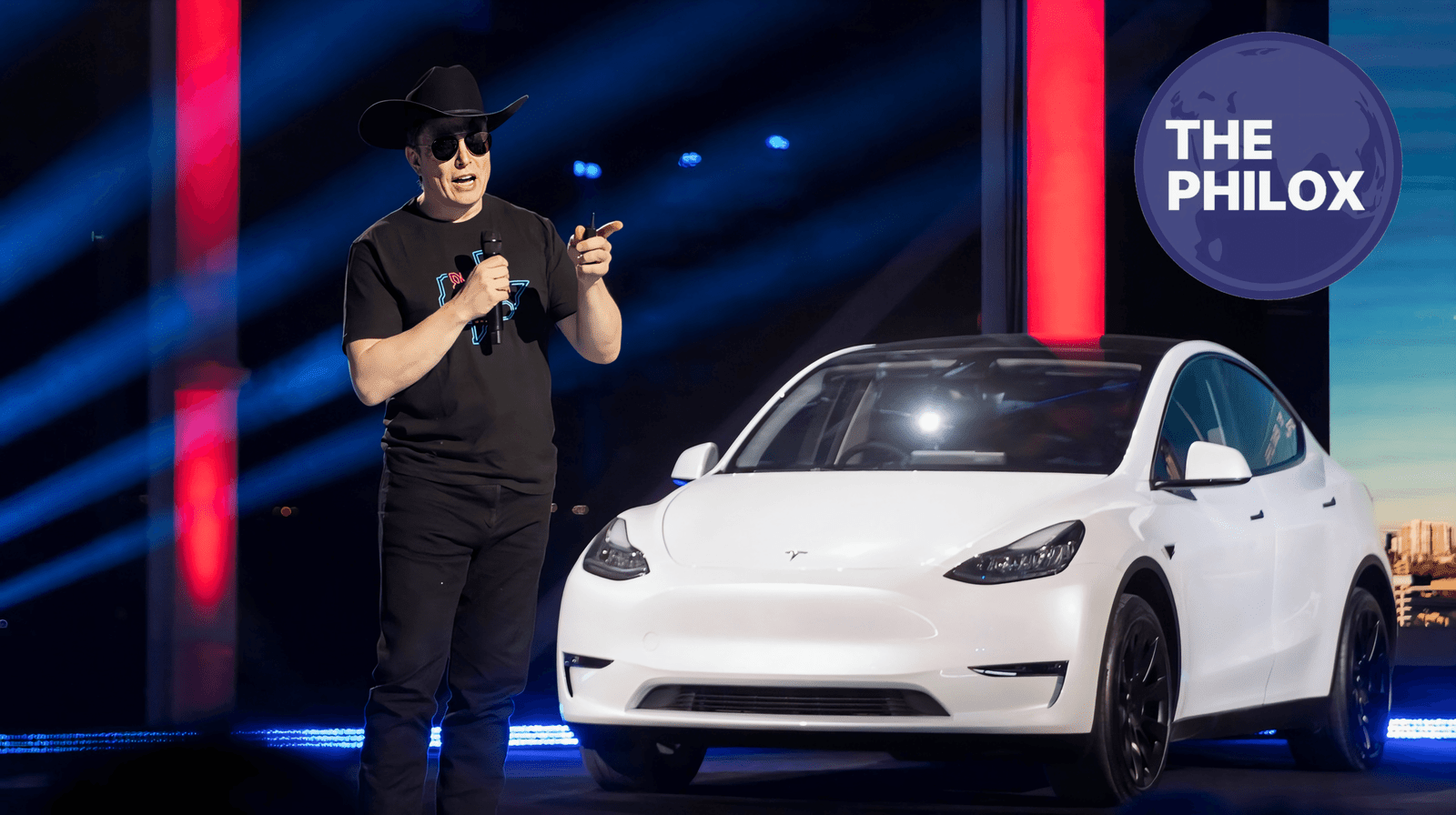

Donald Trump Wins Election: A Temporary Silver Lining

At least part of the motivation behind the recent surge in Bitcoin’s price has been attributed to Donald Trump winning the presidential election. Markets tend to react to political events, and Trump’s stance on deregulation and economic policies may have spurred temporary optimism among investors.

However, this silver lining is unlikely to last:

- Political events tend to induce short-term price movement rather than long-term growth.

- Regulatory bodies would not ease their oversight based solely on the election of Trump.

Declining Adoption

While Bitcoin will initially be touted as the future of finance, adoption is slowing. This can be seen through the following indicators:

Retail Interest

Google Trends data indicates a decline in searches relating to Bitcoin, and therefore retail investors are becoming disinterested.

Institutional Pullback

The biggest financial institutions have lessened exposure to cryptocurrency due to the instability in the market and regulatory constraints, which include BlackRock and Goldman Sachs.

Merchant Acceptance

While a smaller number of merchants are starting to accept Bitcoin as a payment form, they cite its volatility in charges and slowness in processing transactions.

Technological Limitations

Bitcoin’s blockchain has several technological constraints:

1. Scalability Issues

It can only process around 7 TPS, while Visa’s can do around 65,000 TPS.

2.High Transaction Fees

Transaction fees can balloon to extreme levels during peak demand, making Bitcoin impossible to use in real life.

3.Competition of Altcoins

Ethereum and Solana have recently been discovered, with higher transaction speed and much more functionality, thus decreasing usage of Bitcoin.

Declining Prices of Bitcoin

The impact of this would be felt as follows:

1.Investor Losses

Retail investors, usually jumping into the market at price highs, are prone to facing huge losses.

2.Market Instability

A sharp decline in Bitcoin’s value could destabilize the broader cryptocurrency market, leading to liquidity crises.

3.Loss of Credibility

A prolonged downturn could erode public confidence in Bitcoin and cryptocurrencies in general, stifling innovation in blockchain technology.

The Smarter Investment Alternatives

For those looking to diversify their portfolios, traditional investments offer greater stability and returns:

- Equities: Investing in established companies with strong growth prospects.

- ETFs: Exchange-traded funds provide diversified exposure to markets with lower risks.

- Real Estate: Hard assets that increase value over time and generate rental income.

- Gold: A safe haven of value during times of economic uncertainty.

Conclusion

The current high price of Bitcoin may attract investors, but the associated risks have a much higher weight than rewards. Its volatility, lack of intrinsic value, regulatory challenges, and adverse effects on the environment make it an imprudent investment option. Long-term trends will further indicate decline, despite the surge seen after Donald Trump emerged as the winner of the recent elections.

As such, it makes perfect sense for most investors to stick with more traditional, regulated asset classes. Bitcoin, hype aside, probably is not the financial revolution many had envisioned.