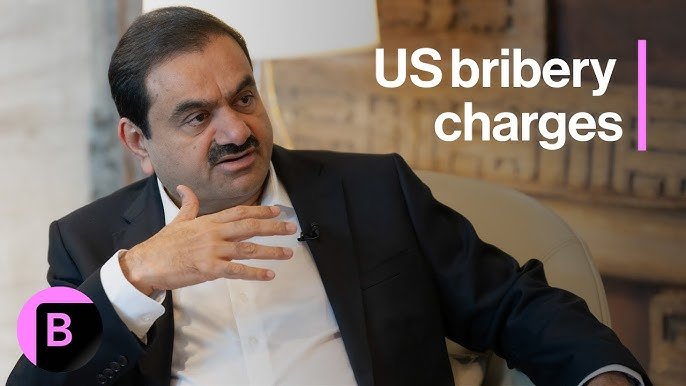

Adani Power's stock price will likely drop by at least 80% due to the alleged bribery and...

Hindenburg Research

Adani Group faces a 50-60% cut in stock prices in the wake of alleged fraud, stock manipulation,...

The Adani Group, led by Gautam Adani, is in the crosshairs of a bribery and corruption case...